As India advances toward its 500 GW renewable energy target by 2030, corporates are also accelerating efforts to achieve their RE100 goals by sourcing power from renewables. Open Access has emerged as a viable and scalable solution for Indian businesses, with models like Group Captive offering mutual benefits to both developers and consumers.

What is Group Captive Open Access?

Group captive open access is a unique model where multiple commercial and industrial (C&I) consumers collectively invest in a renewable energy project to fulfil their unique or specific power needs.

As per the applicable rules, to qualify for group captive open access:

- Consumers must jointly own at least 26% of equity in the renewable energy project.

- They must consume at least 51% of the power generated.

This model enables companies to procure cheaper, cleaner energy without having to build or fully own a dedicated plant. The group captive power model in India is ideal for corporates looking to reduce power costs, cut emissions, and scale up renewable energy procurement with minimal capital investment.

Why Is Group Captive Open Access Gaining Traction Among Indian Businesses?

More corporates are embracing the group captive power model due to:

- Stringent Net Zero/Decarbonization goals.

- Strong regulatory backing.

- Support from investors, customers, and government stakeholders for Sustainability initiatives.

- Cost-Savings per unit electricity.

Today, many leading companies are adopting group captive solar, wind or hybrid power plants to future-proof their energy strategies.

Benefits of the Group Captive RE model

- High Advantage with Partial Investment: Consumers are not required to fund the entire project – just a 26% equity stake, making it a financially viable option.

- Strong Cost Benefit: Procuring power through group captive open access can result in 30% to 50% savings compared to grid tariffs.

Additionally, consumers can benefit from waivers on cross-subsidy surcharges, transmission charges, and other regulatory charges, depending on state policies. - Meets High Energy Demands: This model is highly suitable for energy-intensive firms with large and consistent electricity requirements.

- Scalable and Flexible: The group captive power model supports scalability. It is an important factor because energy procurement can grow with business needs.

- No On-Site Space Needed: Unlike rooftop or ground-mounted systems installed at the premises of client, a group captive solar plant is located offsite, eliminating any concerns about space constraints near the facility.

- Round-the-Clock Energy: Reliable RTC (Round-the-Clock) supply can be structured based on the project’s hybrid configuration and plant dynamics.

Accelerates Net Zero Goals: Group captive open access model can become a powerful enabler to decarbonize operations and meet sustainability and ESG compliances.

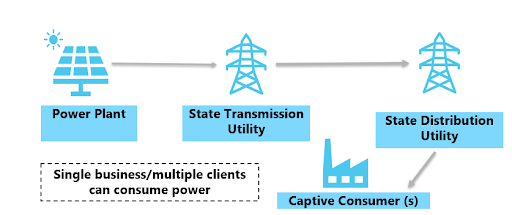

Power Flow in a Group Captive Open Access Model

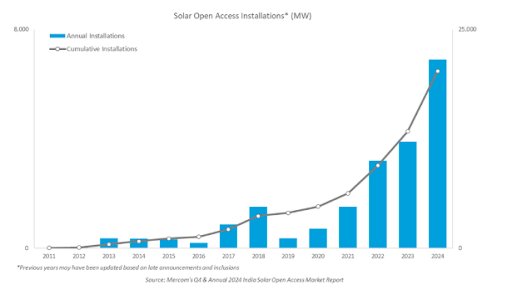

India’s Open Access Renewables Market

India added a record 21.9 GW of new solar and wind capacity in H1 2025 (January–June), representing a 56% year-on-year increase. Of this, 18.3 GW was solar, led by 14.3 GW of utility-scale installations, a 49% rise over H1 2024. The wind sector contributed 3.5 GW, which is 84% higher than the 1.9 GW added during H1 2024. Gujarat, Rajasthan, and Maharashtra collectively accounted for over 50% of total solar and wind additions during this period.

Commercial & Industrial (C&I) consumers remain a critical driver – the cumulative renewable capacity for direct sourcing by C&I stood at 18.7 GW by end-FY 2024, after a 90.4% year-on-year jump in FY 2024 alone. The solar open access market added 1.1 GW in Q1 CY 2025, bringing total installed capacity to 21.5 GW as of March 2025.

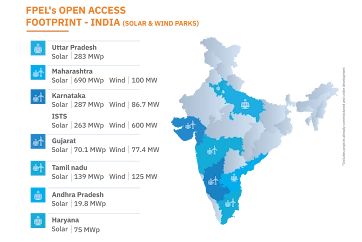

FPEL’s Pan India Solar and Wind Energy Footprint

Fourth Partner Energy has a strong pan-India presence in the Open Access segment. Our solar, wind, and hybrid parks are delivering reliable clean energy to several leading corporates across the country.

The figures below highlight our pan-India presence in the Open Access segment.

Note: These capacities include projects under development as well.

At Fourth Partner Energy, we are proud to be driving clean energy transition for India’s corporates – making renewable energy procurement simpler, scalable, and more accessible.

Marquee Open Access clients of Fourth Partner Energy

Frequently Asked Questions

How Group Captive is different from Captive or Third-Party models?

- Captive: A single consumer owns 26%+ equity and consumes 51%+ of the energy.

- Group Captive: Multiple consumers jointly meet the same criteria.

- Third-party: The developer owns the asset and sells power via Power Purchase Agreement (PPA); no ownership is transferred to the consumer.

What is the typical tenure of a Group Captive PPA?

Generally between 10 to 25 years, depending on the project size, state policy, and stakeholder requirements.

Is the Group Captive model suitable for small or large consumers?

The Group Captive model is best suited for medium to large power consumers with consistent energy demand. However, smaller entities can also participate by aggregating their demand with other similar businesses or by partnering with a developer who manages the compliance and structuring.

Which partner is best suited for a Group Captive collaboration?

A partner who offers end-to-end Group Captive solutions, from Project development to performance optimization and knows group captive solar power plant policy is ideal.

What are the risks involved in an Open Access project and how can they be tackled?

Risks include policy changes, delays, or developer inefficiencies, but these can be managed by choosing an experienced RE provider.

Want your business to join the group captive model?

Write us at marketing@fourthpartner.co