India’s rooftop solar capacity is set to rise from 17 GW in fiscal 2025 to 30 GW by fiscal 2027, driven by a strong 33% annual growth rate, largely led by the commercial and industrial (C&I) segment.

Rooftop Solar has become a strategic priority for businesses looking to reduce their energy costs, meet sustainability goals, and secure long-term energy independence. With C&I consumers accounting for nearly 66% of India’s total rooftop installations, this segment is at the forefront of the country’s energy transition.

As industries face rising electricity tariffs and stringent net zero goals – commercial rooftop solar in India has emerged as a reliable, cost-effective, and future-ready solution. The momentum clearly signals a transformation in how businesses generate and consume power.

Why is Rooftop Solar Gaining Traction in India’s C&I Segment?

The benefits of commercial rooftop solar in India are becoming increasingly compelling, especially for the C&I sector. With rising grid electricity tariffs, businesses are facing eye-watering energy bills, often comprising up to half of their operating costs. By adopting rooftop solar, they can lock in stable, low-cost electricity for 25 years, shielded from unpredictable tariff hikes and grid volatility.

Imagine a manufacturing plant paying ₹9 per kWh today. By switching to rooftop solar, it can achieve a 30–50% reduction in energy costs. This isn’t just a cost-saving measure, it’s a strategic move that enhances competitiveness and improves margins.

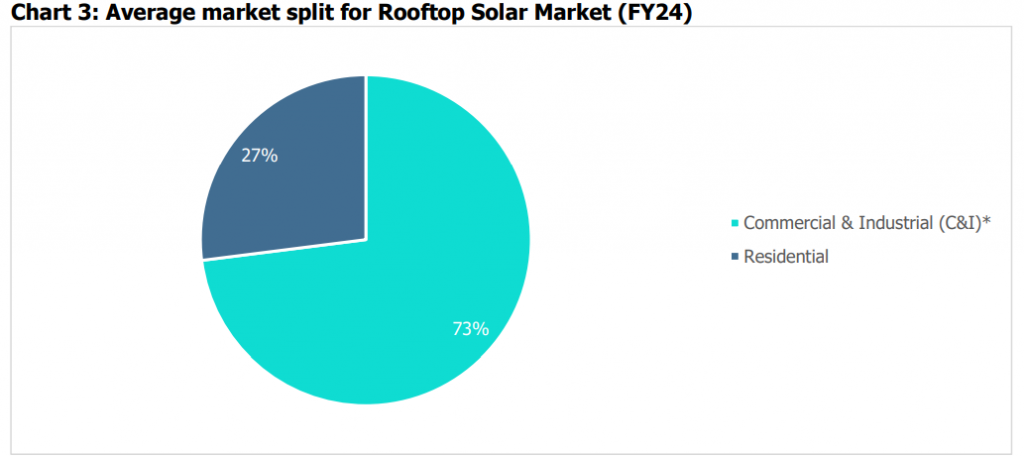

Moreover, C&I users account for roughly 49% of India’s electricity consumption, but a mere 3.5% of their demand is met through renewables. This disparity highlights both the opportunity and momentum. Rooftop solar installations currently responsible for 70–80% of the total rooftop market are increasingly preferred for their immediate impact on cost efficiency.

One key enabler here is net metering, which allows businesses to feed surplus solar energy back to the grid and earn credits. Although policies vary by state, most regions especially Gujarat and Maharashtra offer strong frameworks that boost ROI and make solar even more attractive.

Source: IEEFA. CareEdge Research *C&I includes government segments as well

Key reasons why rooftop solar is gaining traction among industries:

- Up to 50% cost savings on power bills

- Energy independence and tariff stability

- ESG alignment and emissions reduction

- Additional revenue from net metering

- Quick payback periods of 3–4 years

Growth Drivers of Commercial Solar Adoption in India

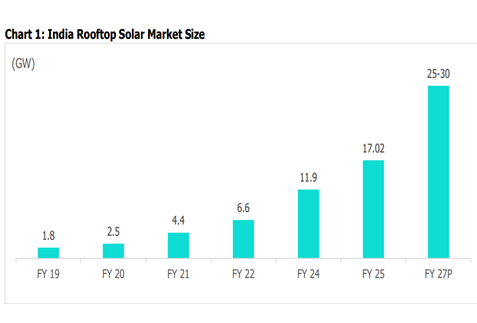

India’s rooftop solar market has experienced consistent growth, thanks to favourable policies, falling solar costs, and rising C&I adoption. Installed capacity has grown from just 1.8 GW in FY 2019 to over 17 GW by FY 2025 and is projected to touch 30 GW by FY 2027.

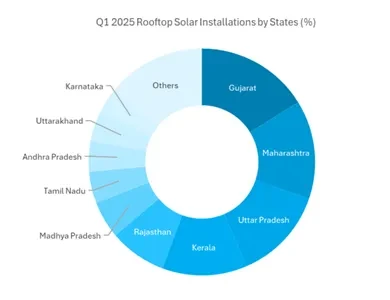

Source: Mercom's Q1 2025 India Rooftop Solar Market Repost

Source: MNRE, CareEdge Research; P: Projected; Data refers to Cumulative Capacity; FY23 data not available

States like Gujarat, Maharashtra, and Uttar Pradesh are leading the way, backed by supportive state policies, robust net metering frameworks, and high industrial demand. These regions have become hotspots for rooftop solar adoption.

Energizing Industries: FPEL’s Role in India’s Solar Transition

With rising energy costs and an urgent push toward sustainability, industries across India are turning to solar to future-proof their operations.

Fourth Partner Energy is enabling this shift by offering customized solar solutions that reduce carbon emissions and improve energy efficiency. Here’s how FPEL is supporting key sectors:

Unlike traditional providers, FPEL doesn’t just offer rooftop solar. It delivers comprehensive on-site solar (rooftop, ground-mounted, and carport systems) as well as open access solar power through our solar parks providing flexibility, scale, and cost optimization.

Toyota Kirloskar Motors

9.4 MWp Rooftop Solar System in Bangalore

V- Guard

1 MWp Rooftop Solar System in Hyderabad

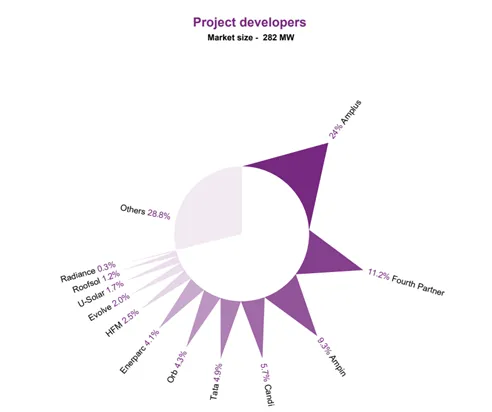

Adding to its credentials, FPEL has been officially ranked 2nd in the Developers (On-Site) Category by CRISIL – BRIDGE TO INDIA. This recognition reflects the company’s leadership, execution capability, and strong portfolio across pan-India.

With deep sectoral experience, strong partnerships, and a 360° approach to clean energy, FPEL continues to be the preferred renewable energy partner for businesses across India.

As India moves toward a low-carbon economy, commercial rooftop solar is quickly becoming the default energy strategy for forward-thinking industries. With proven savings, policy support, and sustainability value, it’s not just a trend it’s the new industrial standard.

And with trusted partners like Fourth Partner Energy, businesses are not just adopting solar, they’re leading India’s clean energy revolution.

FAQs

What is the installation process, and how soon can I benefit from solar power?

Installation consists of site assessment, design, permitting, and implementation. You can see savings from 2-4 months of installation, depending on the size of the project.

Is net metering available for C&I?

Yes, in many states. It allows exporting surplus power to the grid for credits.

How much area is required for rooftop solar?

Actual roof area required at your installation could vary based on site-specific conditions and vendor’s recommendations. Based on the above, we can see that a rooftop solar PV system typically requires 100-130 SF (about 12 m2) of shade-free roof area per kW of capacity.

Is backup power available during outages?

Grid-tied systems shut off during grid outages. For backup needs, hybrid or off‑grid systems with battery storage are required.